GP-led venture capital secondaries have been continuing to scale but today remain a small part of the venture capital ecosystem. While private equity has seen a significant portion of its market activity driven by GP-led secondaries, venture capital GPs are only just now beginning to embrace the transactions.

In private equity, GP-led secondaries are often utilized to provide liquidity and extend hold periods for high quality assets and facilitate fund restructurings.

But venture capital GPs have clung to the adage that “companies are bought not sold” and “IPO windows are open, or they are not” and have been willing to extend fund timelines well beyond contracted fund lives without forcing an exit.

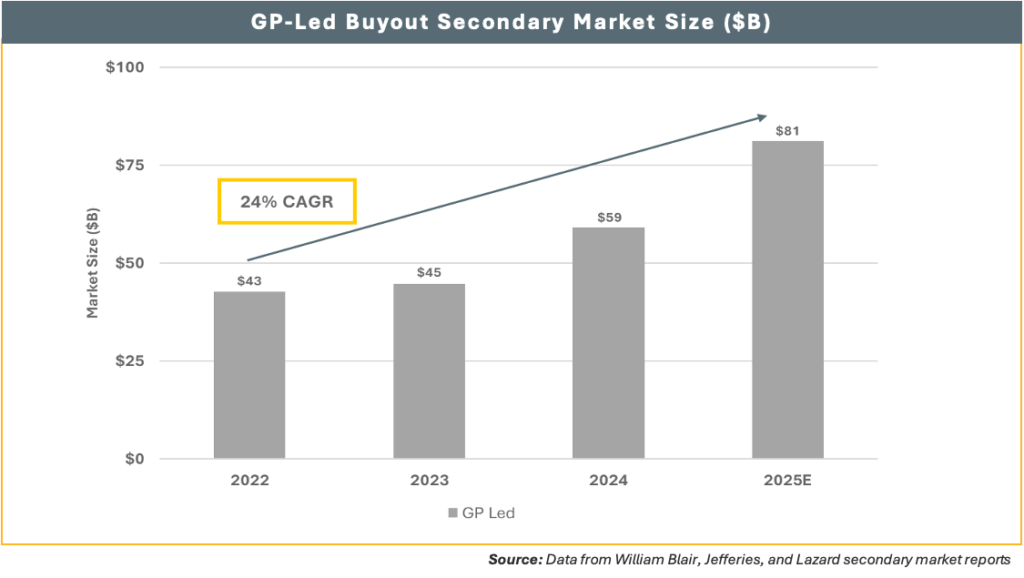

For secondaries overall, 2024 marked the strongest performance in the secondary market to date, with GP-led secondary market volume exceeding by 10% record levels achieved in 2021. GP-led secondaries reached $72 billion in 2024,1 with a notable surge in activity in the second half of the year. This trend has continued into 2025.

This performance contrasts sharply with the M&A and IPO markets, which are still 40% and 78% below 2021 levels, respectively.2

Within this overall environment of secondaries growth, there are a number of factors that will drive the growth of GP-led venture secondaries:

•The macro environment for GPs and venture-backed companies

•The nature of venture investment

•Limited information availability

•Power law (80/20) return dynamics

•Governance/control considerations

•Valuation challenges with venture investments/secondaries

•The regulatory environment for GPs

•The depth and breadth of the secondary venture buyside environment

Macro Environment for GPs and Venture-Backed Companies

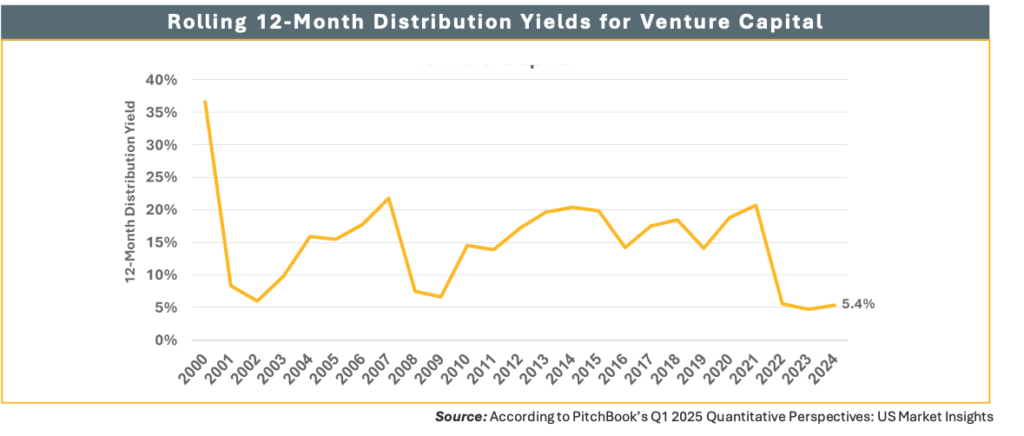

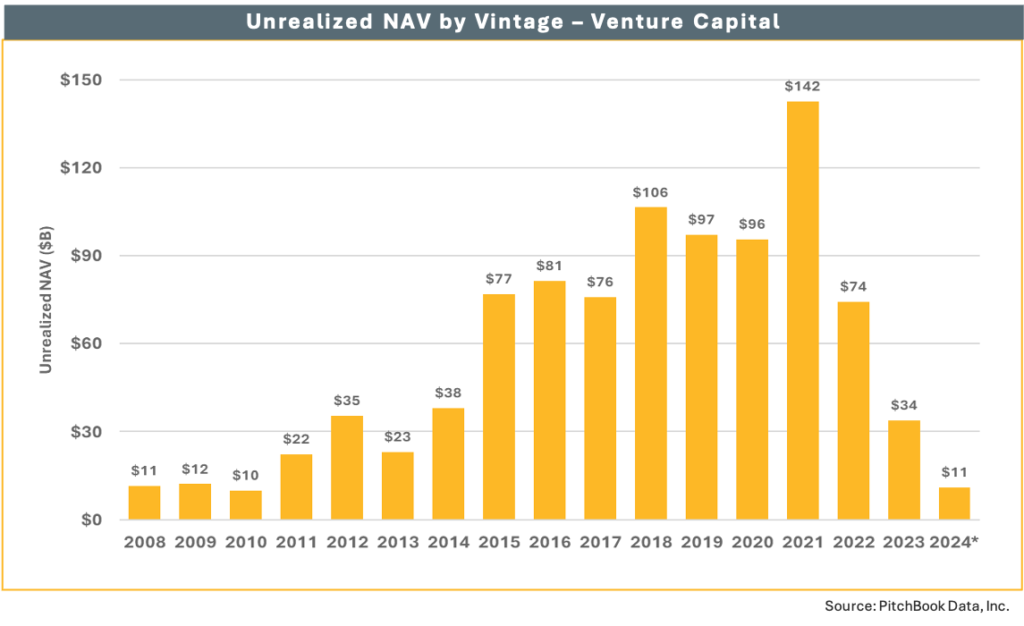

The current venture capital market is characterized by few exits events leading to fewer distributions. This puts significant pressure on venture capital funds to generate liquidity for their limited partners (LPs) by proactively managing assets rather than waiting for an exit. Several key factors are expected to grow secondaries in the VC world. First, valuations have started to adjust downward to more appropriate levels as last round financings in 2024 and 2025 begin to reprice holding values from rounds done in 2021 and 2022 – thereby decreasing apparent discounts to NAV for secondary transactions. Second, recent transactions by well-regarded ventures firms such as NEA and Lightspeed allow for general acceptance of these types of secondary events. Third, the aforementioned drought of traditional liquidity events such as strategic sales and IPOs has caused venture firms to actively pursue other liquidity options.

The Nature of Venture Investment

Limited Information Availability: Many VC’s who mostly have minority positions, some of which can be quite small, often do not have ready access to much of the standard financial and operating information that buyout funds have access to. While buyout deals typically provide data on revenue, margins, EBITDA, and cash levels, Some venture GPs may lack these metrics on many of their investments if they aren’t on the boards of these companies or have or take advantage of information rights. Investors in VC companies also have more variables to consider, such as new product launches and product strategies, management changes, LTV and CAC metrics. For these reasons, knowledge and experience of the buyers, of which there are few, and access to proprietary data, is essential to success and has historically limited the buyer universe.

Power Law Dynamics in Venture: More so than in private equity, the “Power Law” applies in venture assets, whereby over 80% of the returns are driven by less than 20% of the portfolio companies (and in one older published study by Horsely Bridge, 5% of investments accounted for 60% of total returns).3 Historically, in GP-led transactions in PE, only the best few companies are included in the transaction, thereby attracting the limited secondary capital that exists for these transactions. However, in venture, if that happens the assets not chosen are stranded – and no LP wants to own stakes in the 80% of investments that are going to return 20% of the outcome. Therefore, transactions in venture need to be structured differently to address the Power Law dynamics.

Governance / Control Considerations: Unlike in PE, venture investors do not control the board and the decision making of the company. Venture owners cannot force a company to exit. As such, investors in secondary transactions where VC assets that have no obvious exit and no mandate or consensus from the board about the timing or criteria for an exit often create less demand and lower pricing from secondary firms leading to greater discounts from NAV versus PE assets.

Macro Environment for GPs and Venture-Backed Companies

Determining fair valuations for venture-backed companies can be complex. There are broad variances in startup valuations, sometimes making it difficult for buyers and sellers to agree on prices. Often five investors in a company that hasn’t done a financing in the past 2+ years may all be holding the asset at different valuations. Due to the fundamentally difficult nature of assessing technology companies whose outcomes could vary wildly and may be hard to predict, often with restricted information, the ability for price discovery and agreement with secondary buyers is much more challenging. In the PE world, disagreements around what multiple of EBITDA to pay happen, but differences in value perception are much smaller than in the venture world where strategic value, competitive differentiation, growth rates and improving operating metrics often create afar broader difference in views than just what multiple of EBITDA is appropriate.

The Regulatory Environment for Venture GPs

Unlike PE firms, all of which are registered with the SEC as Registered Investment Advisors (RIAs), the majority of venture capital firms operate without registration due to an arcane exemption.

Specifically, venture GPs are subject to the Venture Capital Operating Company (VCOC) exemption within the Employee Retirement Income Security Act (ERISA) that allows certain venture funds to avoid being treated as a regulated financial entity. Venture GPs often lose this exemption if they engage in secondary transactions. GP-led transactions in venture capital require that before completing the transactions, the GP needs to register with the SEC as an RIA (requiring cost, ongoing compliance and a variety of restrictions on marketing, communication and fiduciary requirements). Very few venture GPs want to lose their VCOC exemption, which has inhibited them from doing GP-led transactions. Recent activity by market-leading firms in the GP-led venture secondary market has allowed for transactions to occur whereby the buyer acts as the GP for the transaction and uses their RIA registration to comply with SEC rules, but this development is relatively recent.

The Depth and Breadth of the Secondary Venture Buyside Environment

The PE secondary market is more mature, with large established investment managers and a larger volume of transactions. The GP-led market for PE assets is now bigger than the LP secondary market for PE.

But in venture, the market is small with only a handful of experienced venture secondary fund managers. This is likely to change as the size of the venture market continues to expand . The amount of remaining invested capital in venture funds over 10 years old is substantial (over $200 billion) and expected to continue increasing in the future.4 This trapped capital needs to be addressed and there are few better alternatives to address this than the GP-led strategy.

Limited partners in venture funds are demanding liquidity. Increasingly, these LPs will demand liquidity through secondaries as a means of managing their portfolios, especially as funds mature.

The number of venture backed companies that are mature enough for secondary sales is still relatively small, but increasing rapidly. As these companies move beyond their growth phase, and start resembling their PE counterparts, they become increasingly suitable for secondary sales.

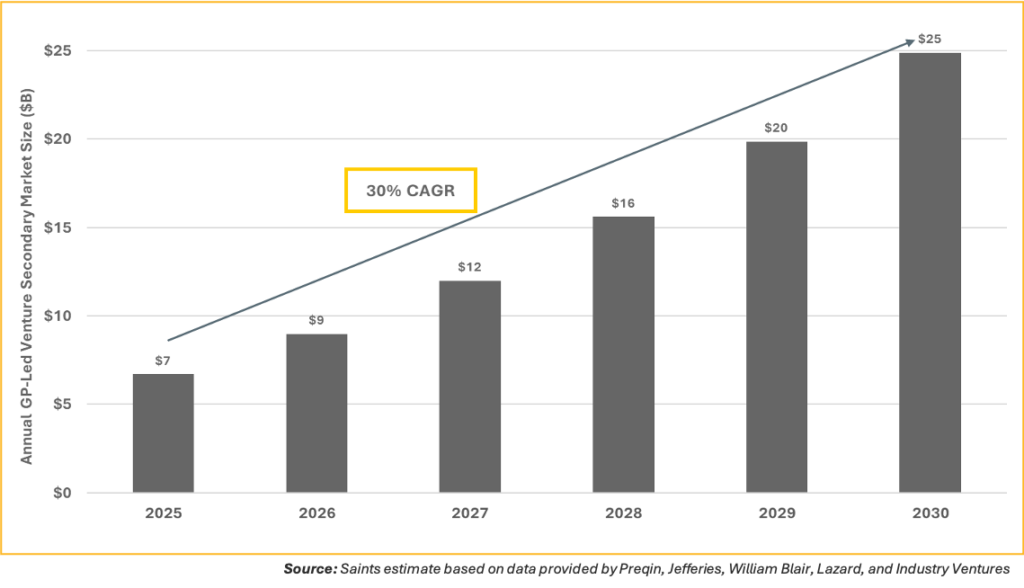

While venture capital / growth funds accounted for approximately 7% of total LP-led and GP-led secondary volume in 2024,1 for the reasons cited above, we believe the percentage will grow meaningfully over the next several years.

The secondary market is well-positioned for continued growth, building on the record momentum of 2024. With an expanding buyer universe, increasing maturity of venture portfolio companies and continued demands from LPs for liquidity, we expect consistent strength in venture secondary activity, shrinking the gap in secondary volumes relative to the PE universe.

Sources

1 Lazard (2025). Secondary Market Report 2024

2 According to PitchBook and NVCA’s Q4 2024 Venture Monitor Summary

3 Andreessen Horowitz (2015). Performance Data and the ‘Babe Ruth’ Effect in Venture Capital

4 PitchBook Data Inc.

Disclosures & Legal Disclaimer

The information set forth above shall not constitute an offer, solicitation or recommendation to sell or an offer to purchase any securities, investment products or investment advisory services. Offerings are made only pursuant to a private offering memorandum containing important information regarding risk factors, performance and other material aspects of the applicable offering; the information contained herein should not be used or relied upon in connection with the purchase or sale or any security. The information provided herein does not constitute a representation that any investment strategy or fund investment is suitable or appropriate for any person. Discussion of Saints’ investment strategy includes certain target allocations and objectives, which are targets and objectives only, and there can be no assurance that such target allocations or objectives will ultimately be achieved. These materials are confidential and have been prepared solely for the information of the intended recipient and may not be reproduced, distributed or used for any other purposes. Reproduction or distribution of these materials may constitute a violation of federal or state securities laws.