For decades, venture secondaries has been the red-headed stepchild of the secondaries market. While the largest secondary funds – those focused on buyout assets – have grown substantially in size and expanded their transaction scope from pure LP transactions to GP-led single and multi-asset continuation vehicles, many venture-focused secondary firms that started decades ago have disappeared, folded, or morphed their strategy to encompass growth investing, fund of funds and other strategies.

But the world has begun to change. There is little return dispersion amongst buyout-focused funds, and while these funds have generated mid-teen returns, they have oftentimes had to do so by using leverage during periods of relatively stable economic conditions.

Meanwhile, the secondary market for investments in top venture capital names exploded over the past five years with record transaction volume in 2021.1 The majority of these investments were purchased by hedge funds, crossover funds, traditional VCs desiring to add certain names to their portfolio, and by family offices. After serious market declines in the valuations of growth assets in 2022, however, many of these buyers stopped pursuing these transactions or greatly reduced their activity due to disappointing returns or reduced fund sizes. Nevertheless, the increased volume in secondary transactions during this period has helped institutionalize the venture secondary market, with the “old guard” secondary venture institutional investors such as Saints and Industry Ventures being joined by G2, Greenspring/Stepstone, Pinegrove and others that bring a more institutional approach. Despite this growth, the penetration of LP-led and GP-led secondary sales in venture capital remains vastly lower than in the buyout world. The level of secondary transactions in venture capital is just 0.4% of NAV, versus almost 3.0% in the buyout world,2 and demand for solutions to help wind up old venture funds is generally not addressed by the majority of venture secondary funds.

Currently, there are five factors driving the rapid growth of the venture secondaries market:

• Historic illiquidity for venture-backed companies and for venture funds that has starved limited partners of distributions

• Massive buildup of NAV in older funds as a result of increased limited partner commitments into the asset class and increased fund sizes over the past decade

• Emergence of GP-led transactions, popularized in the buyout secondary market, which is now being copied by VC-focused secondary firms

• Proliferation of single asset secondaries in top venture capital backed names driving other private companies and VC firms to embrace liquidity from institutional secondary firms

• Recent success of venture-focused secondary firms in attracting more capital

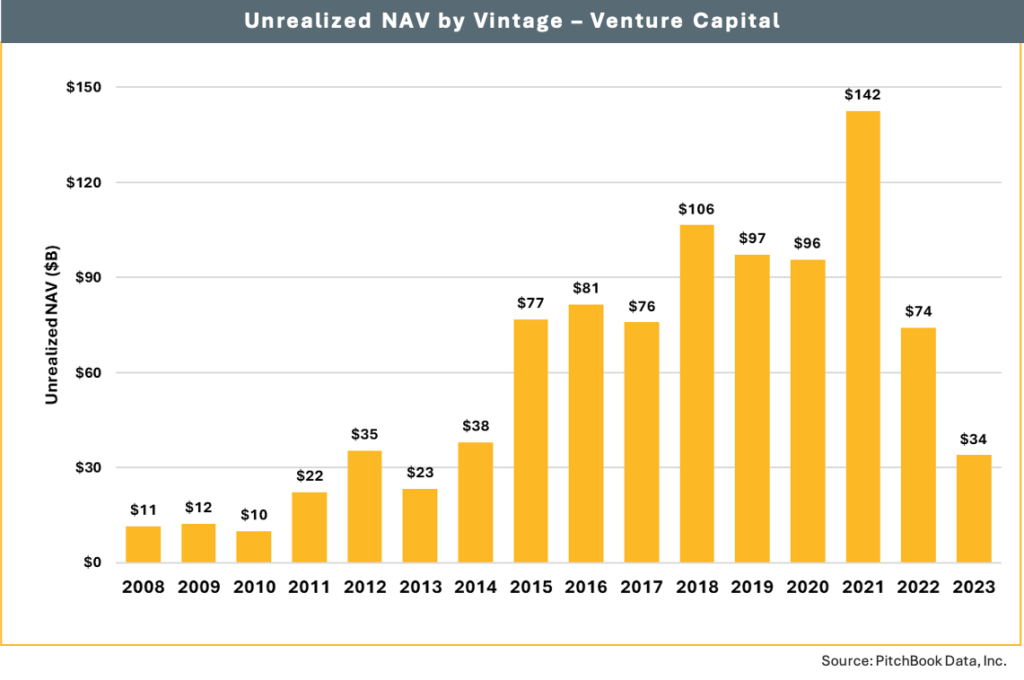

Over the years, this extended period to wind up a venture fund was a relatively small problem within the overall scope of the alternative asset industry, because the venture capital market size was quite small, and so the “trapped NAV” problem wasn’t significant. However, the growth in the venture industry over the past fifteen years means this problem is growing significantly.

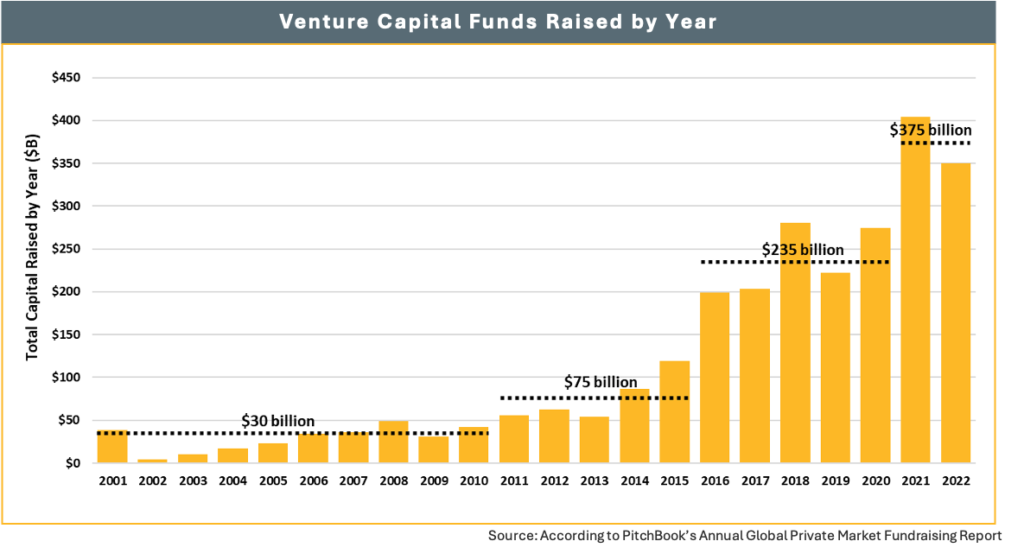

As reflected in the chart – there have been a few phases of fundraising activity in venture funds: Pre-2011 where the average raised per year was $30 billion per annum; 2011-2015 when the market more than doubled; and 2016-2022 when venture market ballooned. As a result, the venture capital industry has become a true asset class unto itself, and so the size of the “Trapped NAV” will grow to reflect this massive build-up of capital invested.

Even today, as shown in the chart below – the buildup in NAV in older funds is already significant – almost a quarter of a trillion dollars – and with the increased investment in the asset class, it is expected to grow significantly.

Emergence of GP-led Solutions

The growth of GP-led secondary transactions (where a fund general partner facilitates the sale of assets from an existing fund to a new vehicle – usually where the GP continues to manage the assets) has been significant amongst private equity funds over the past decade.

Growth of GP-Led Secondary Transactions:

•Pre-2016: GP-led deals were a niche part of the private equity secondary market — under 20% of total secondaries volume5

•2016–2019: Growth accelerated, with GP-led transactions becoming a more accepted tool, increasing in volume to make up ~30% of the $80–90 billion secondary market by 20195

•2020–2024: The trend explodes despite COVID-19 headwinds, with GP-led transactions making up 40–50% of total secondary volume, exceeding $60 billion per annum6

•2025 and beyond: It is widely expected that GP-led transactions will gradually exceed LP-led transaction volume in the PE space

What was once seen as a distressed or conflicted process is now mainstream resulting in standardized processes, including the introduction of fairness opinions and investment banker involvement improving credibility. While these transactions have become mainstream in the buyout market, they are still a small part of the venture capital market. Only a few billion dollars a year of GP-led transactions in venture capital have occurred over the last few years – and the relative penetration of these transactions in venture capital is just a third of levels in the buyout market. As such, many industry experts expect the volume of GP-led transactions in venture capital to grow dramatically in the coming years.

Growth in Single Asset Transactions in the Venture Capital Industry

When Saints first began investing in secondary transactions 25 years ago, the idea that a smart venture capital fund would ever sell any of their investment in a great portfolio company to another fund was met with tremendous skepticism. The fact that every day, a super smart hedge fund manager sells public stock to another super smart hedge fund manager was not convincing, and one magazine article referred to Saints as “Silicon Valley’s Garbage Collectors”. Today, 80% of secondary transaction volume of venture capital positions sold on the variety of bulletin boards and websites offering shares for sale via secondary exchanges are in the top-ten best names in venture capital, such as SpaceX, Stripe, and Databricks. And interestingly, according to a senior executive at Forge, one of the leading exchanges, the overwhelming majority of buyers for these assets are non-institutional investors – family offices, hedge funds, and SPV’s marketed to a variety of HNW individuals. The institutional investors on the other hand, are often seen in the next 1,000 names of unicorns or fast-growing companies that most retail investors and family offices have never heard of. Venture capital firms that have successfully sold some of their top investments into the secondary market are increasingly asking other good companies in their portfolio to allow them to achieve liquidity by selling some or all of their position – and to facilitate the transactions by allowing information to be shared with potential buyers.

Historically, this type of cooperative process has been limited, but companies have recently begun warming up to the idea of becoming more cooperative as industry thought leaders begin to articulate the importance of secondary sales to the ecosystem. Over time, it is expected that more and more secondary sales in successful companies will occur in companies beyond the top ten “hottest” names and that the percentage of total transactions will broaden to include many more names amongst single company transactions.

Success of Venture-Focused Secondary Firms is Attracting More Capital

Traditionally, most of the venture capital secondary investment activity was done by the large, multi-strategy mega-funds – Harbourvest, Lexington, Coller, Goldman Sachs and a few others. Most large secondary funds still avoid the venture capital asset class (Ardian and Ares are a few focused exclusively in buyout assets). It is only in recent years that the secondary firms with a venture focus have been able to raise billion dollar plus funds.

One of the attributes of secondary funds has been that return dispersion is small – bottom quartile in the 11% IRR range and top quartile in the 18% range.7 This dispersion is smaller than almost any other asset class. As a result, little differentiation emerged between strategies as capital was relatively easy to acquire, and taking extra risk wasn’t meaningfully apparent in the returns. As venture-focused funds began to raise larger funds they exposed their returns to the broader institutional market. As such, institutions began to see some venture secondary firms showing IRRs in the mid-20’s and began to allocate capital to these firms. The institutional market began to have more than one investment in secondary funds – often a large multi-strategy fund, a small fund focused on mid-market PE, and an alternative strategy. As venture has emerged as a strategy that provides the possibility of significant outperformance, investors are beginning to embrace a broader portfolio of secondary venture managers – a trend that will continue, most expect, for years to come. After all, if you have 10 PE managers why wouldn’t you have an equal number of secondary managers if the returns are equal to or better than PE, and return of capital is quicker?

The emergence of specialization amongst venture capital focused secondary funds has allowed investors to differentiate strategies and select ones with appropriate risk/return profiles. A few excellent firms have emerged doing just single asset transactions – much like a growth equity fund. Several remain focused on LP transactions – with the majority of their capital deployed in the traditional part of the market. But perhaps most interesting is the emergence of GP-led firms – following the lead of other notable firms in the PE world who just do GP-led transactions (ICG and BannerRidge for example). This proliferation of strategies is also changing how LPs are thinking about investing in the secondary venture space.

A myriad of factors is driving growth in the venture secondary market – some of it temporal (the closed IPO window for example) but much of it is structural (market size, NAV buildup, LP/GP acceptance of secondaries, etc.). Looking back, it is helpful to look at the early days of the large buyout firms, such as KKR, Forstmann Little, Leonard Green, etc. when the questions were (particularly if the strategy was breaking up the conglomerates and selling divisions separately) “can this go public?” or “which public company will buy this?” The idea of a sale to a secondary investor or another private equity firm wasn’t in the playbook in those days. Yet today, over 50% of the exits of PE portfolio companies are from a sale to a secondary firm or to another PE firm – a “financial buyer” transaction. If buyout firms relied solely upon IPOs and sales to strategic acquirors, the growth of the buyout industry would have been much abated. Similar to other asset classes, venture capital firms also need to embrace more financial buyer transactions for assets to provide liquidity. Secondary transactions are likely to provide much of the liquidity for remaining assets in venture funds in order for the venture capital asset class to continue to attract LP capital.

Sources

1Industry Ventures (2025). 2023 – 2025: How Big is the Secondary Market for Venture Capital

2Based on data compiled by Saints from PitchBook Data, Inc.; *Data has not been reviewed by Pitchbook analysts*, Lazard, Industry Ventures, and Jefferies

3According to PitchBook and NVCA’s Q4 2024 Venture Monitor Summary

4According to PitchBook’s Q1 2025 Quantitative Perspectives: US Market Insights

5Capital Dynamics (2022). GP-Led Secondaries Reshaping the Landscape for Investors, Fund Managers and Portfolio Companies

6Lazard (2025). Secondary Market Report 2024

7According to PitchBook’s Q3 2024 Global Benchmarks Report

Disclosures & Legal Disclaimer

The information set forth above shall not constitute an offer, solicitation or recommendation to sell or an offer to purchase any securities, investment products or investment advisory services. Offerings are made only pursuant to a private offering memorandum containing important information regarding risk factors, performance and other material aspects of the applicable offering; the information contained herein should not be used or relied upon in connection with the purchase or sale or any security. The information provided herein does not constitute a representation that any investment strategy or fund investment is suitable or appropriate for any person. Discussion of Saints’ investment strategy includes certain target allocations and objectives, which are targets and objectives only, and there can be no assurance that such target allocations or objectives will ultimately be achieved. These materials are confidential and have been prepared solely for the information of the intended recipient and may not be reproduced, distributed or used for any other purposes. Reproduction or distribution of these materials may constitute a violation of federal or state securities laws.